What is a “Paramed”?

The best rates when applying for life insurance are medically underwritten rates that involve testing, the insurance company has you evaluated by a Paramed company. A paramedic, usually a nurse, comes to your location as a third party, representing the insurance company. A paramedic will do the following.

- Take a sample or urine

- Take a sample of blood

- Take blood pressure

- Record your weight

- Record your height

- Take an EKG or other tests depending on the level of coverage

- Ask medical questions

They record the results and send the information to a testing facility where tests will be done to determine your health. This information will be used in underwriting. Many times, this could be the most important part of the whole life insurance process. Inaccurate results could cost you thousands of dollars over the length of the life insurance process.

True Story

Let me give you an example, I have a client, an owner of a business, who was being tested one morning for his life insurance, when the results came back, it was a decline. Not only was it decline but based on the test results the client was told to see his doctor immediately, since his life may endanger. When I talked to the client, he told me he did not fast for 12 hours prior to the test but was having a birthday party for his daughter the night before. He ate cake, lobster and steak and really did not think about the test till the nurse showed up in the morning.

He asked if he could take the test again, the client spent the next 3 weeks eating vegetables, watching his weight, and water fasting 12-hours before the test. The result was he was given a “Preferred Best” rating, the best possible. From Decline to Preferred Best, from no insurance to the best rates possible. Now I want to share with you, how you can save thousands of dollars on your life insurance by being proactive about this process.

Five Ways to Improve your Test Results

The reason an insurance company uses a Paramed is for non-biased third-party evaluation. They don’t know you, its nothing personal, when an insurance company underwrites someone, it can be for a lifetime. A lifetime obligation with payout potential of thousands to millions of dollars requires clear unbiased facts for the insurance company to make the best possible decision. Therefore they can offer the best rates, because they have a full picture of what they are going to insure. So here are 5 ways your can make sure you give them the best possible view of your health status.

- 12-Hour Fast: Make sure to fast at least 12 hours prior to the test, food does have an impact on the results. If you eat butter before nurse arrives, cholesterol from the butter will be in your blood and it will skew the test. Twelve hours gives your body enough time to clear out any material that might affect the results and give an incorrect reading. You can drink water, but stay away from food or non-water beverages, you want a clear reading of your health.

- Get Tested in the morning: When you sleep your body has been relaxed, the pressure is removed from your spine, knees, and ankles for eight hours. Your cells and cartilage are rejuvenated, they are plump and ready for the day. Therefore, you are taller in the morning than in the evening. Since height and weight are factors in determining your classification, the taller the better. One inch in height along with weight can be the difference between Preferred and Preferred Best, or Standard and Standard Plus.

- Change your diet: As noted in the above example, your diet plays an important role in your test results, if you eat fatty and salty foods this not only effects your cholesterol it also affects your blood pressure and other tests. These tests are what the insurance company depends on to give it an unbiased view of your health. If you eat fruits and vegetables for at least a week, you are giving your body time to clear out any issues that might skew the test.

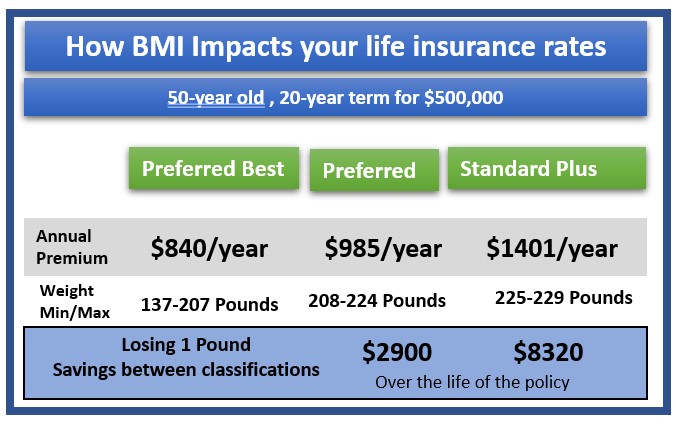

- Loose weight: Along with changing your diet, loosing weight will also save you thousands of dollars in premiums, just one pound can, can have amazing savings. Look at the example below, here is 50-year-old, who is 6-feet tall. The weight range for Preferred Best is 137-207 pounds for that height. If you are 208 pounds you will be classed as Preferred, the cost between Preferred and Preferred Best is $2900 over the 20-year span of the policy. The savings for one-pound is even more dramatic from Preferred to Standard Plus, it is $8320 over a 20-year period.

Not only do you save money, but you will be healthier in the process. Here is a quick point, remember 1 pound of carrots is 250 calories while 1 pound of bread is 2000 calories.

- Pick the right company: Not all companies have the same height and weight bands. One company might be more lenient with their weight then another company. Make sure to find out how far you are from Preferred Best, Preferred or Standard Plus you can then target your weight to get into the best situation based on the amount of life insurance you need.