What is universal life insurance?

Guaranteed Universal Life

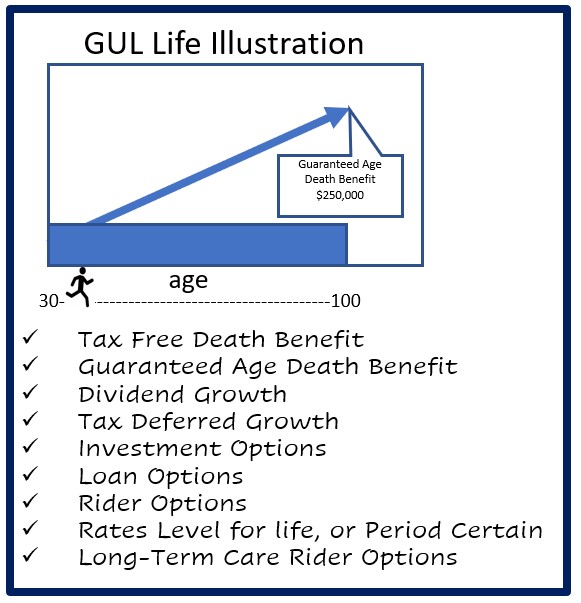

- Universal Life is a flexible permanent type of Life Insurance policy, that guarantees built the death benefit, premium and cash values. Guaranteed Universal Life is a variation of Universal Life that has age specific guarantees in the policy such as to age 95, 100 etc. etc. This means regardless of the cash value in the policy, if the premium Is paid, the policy is guaranteed to stay in force until the specified age.

- Guaranteed Universal Life (GUL) is less expensive than Whole Life because it guarantees the death benefit by a certain age versus a cash value.

- GUL policies can grow in cash value and have various investment options including interest rates and funds indexed to the S & P 500 and other market indices.

- GUL polices can also offer a Return of Premium options, for example in the 20th year of the policy the holder can exchange their policy for a refund of the past 20-years of premium payments.

- GUL policies can also offer Chronic Care Benefits (Long-Term Care type insurance) built into the policy. This means if the policy holder need Long Term Care, the funds can come from the policy before the passing of the policy holder.

- Policy loans can be taken against the cash in the policy.