What is Whole life Insurance?

Whole Life

Characteristics of Whole Life

- Whole Life is a life Insurance designed to last your “Whole” Life.

- Whole Life, like most life insurance policies, has a tax-free death benefit to the beneficiary.

- The premium for Whole Life can be limited to several years or paid for the rest of your life. For example, a 10-Pay Whole Life policy (10-years of premium) is funded to keep the policy current for the rest of your life in the first 10-years. When the cash-value in the policy grows, it funds future premium payments.

- The rates for a Whole Life are based on age, health and gender of the applicant, the lower the age the lower the premium.

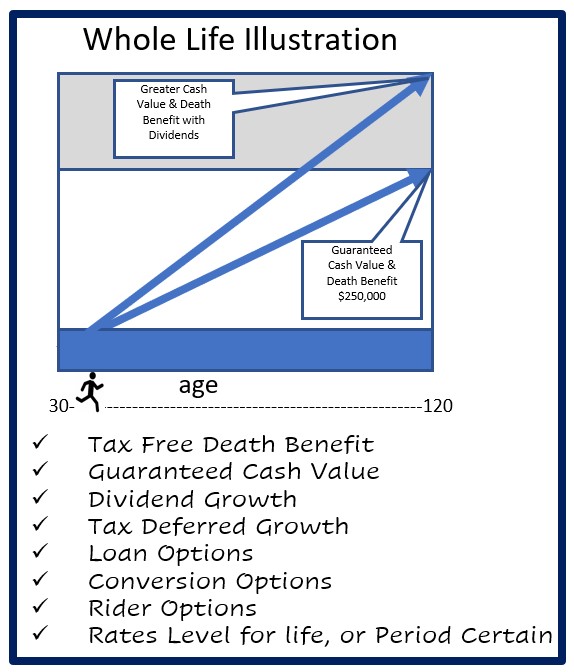

- Whole Life polices are more expensive than Term and Universal Life because of the guarantees. A Whole Life Policy guarantees the Cash-Value of a policy by a certain age as stipulated in the contract. For example, $250,000 Whole Life policy would contractually guarantee that the cash value of the policy at the age of 100 would have $250,000 of cash value, along with its death benefit.

- Whole Life policies can pay dividends, this allows the Cash Value to grow beyond the guaranteed cash value. Using the above example, a $250,000 Whole Life policy might have $500,000 cash, because of dividend growth in the policy. The guarantee is the worst-case scenario in a Whole Life Policy. Dividends are not guaranteed.

- The Cash Value of a Whole Life Policy can be borrowed against the policy. This could be repaid, or it can reduce the death benefit by the value of the loan.