What is Guaranteed Universal Life?

What is Guaranteed Universal Life Insurance?

Before we can understand Guaranteed Universal Life Insurance also known as GUL Life Insurance, we need to understand three basics questions about “Life insurance”.

- What is life insurance?

- How is the cost of life insurance determined?

- What are major types of life insurance?

Getting answers to these questions, will equip you with knowledge of GUL policies. Many people get confused about life insurance because they don’t understand the basics.

- What is Life Insurance?

Just what is “Life Insurance”? Simply, life Insurance is the insuring of the “economic value” of a person. In our lifetime we have an ability to produce income, and collect assets. Our income and assets have an economic value important to those around us: spouses, children, business partners, employer and employees. It is this “economic value” and its liability that is being insured by life insurance.

For example, if you make $100,000/year, your family depends on this income. If you died what would happen? A $1,000,000 policy could provide income for a period of time. This “death benefit” provides the resources for your family due to the loss of your economic value.

- How is the cost of Life Insurance determined?

The next question is how do we determine the value or cost of this insurance? Well there are several main factors to determine the value and costs.

With the process, known as underwriting, the life insurance company uses “actuarial calculations” to determine the likelihood of you passing from illness or accident. For example, statistics show based on 1,000 50-year old males, about 5-males will die in a year and 3-females in the same year[1] (See Chart Below). The insurance company underwrites people to determine the cost of insuring an individual’s life for a specific amount. Once the amount of coverage is determined, the insurer will look at the person’s factors to determine how much to charge based on the risk.

The factors taken into account are:

- Your age ( Young people tend to live longer than older people)

- Height and Weight (height and weight have an impact on longevity)

- Tobacco History (People who do not smoke tend to live longer)

- Driving Record (Safer drivers live longer than riskier drivers)

- Health History (Your individual health history is indicator of future problems affecting your life expectancy)

- Family History (Family histories of illness could be genetic and effect individual health)

These factors are assembled in the underwriting process. The life insurance company then makes an offer based on the amount of coverage desired and the length of coverage desired.

Age of the insured: The older the age, the higher the premium. The chance of an older insured dying is greater than a younger, therefore the risk is greater for the insurance company.

Length of coverage: The other major issue is how long the coverage will be in force. If the policy is term and coverage is for 10-years, the insurers risk is limited for 10-years. If the policy is for 30-years, then the risk is greater. A 30-year old is more likely to die from the ages to 30 to 60 (30-years), then they are from 30 to 40 (10-years).

So when all these factors are put together the insurance company can determine the cost for the life insurance.

- What are the major types of Life Insurance?

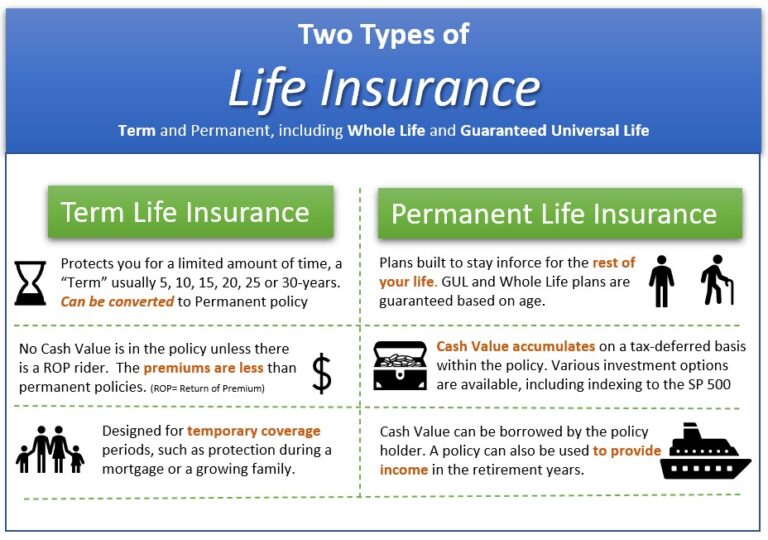

There are two main types of insurance, Permanent and Term.

Term Life Insurance covers you for a “Period” or term of time. It can be 1-year (Annual) 5-years, 10-years, 15-years, 20-years and even 30-years. The longer the Term, the more expensive the policy, because the “Life Insurance Company” has greater risk the longer they are insure a life. A 30-year term policy will be more expensive than a 10-year term policy. The problem with term for many is that it is temporary, that means if you outlive the policy, it may terminate or if you are eligible to continue the policy, the premium can rise significantly.

On the other hand, term insurance is lower cost, so individuals can apply for higher amounts of life insurance, compared to other options.

Permanent Life Insurance is designed to last the rest of your life. There are two main types of permanent policies, Whole Life and Universal Life.

Whole Life: Like the name implies it is for your whole life. These are designed to grow in cash value so that by a certain age, usually 100-120-years, the policy matures or is paid up. The policy is guaranteed to have an equal cash-value to the face amount. With dividends and returns, your benefit amount is more likely to be greater than the guaranteed amount. The guaranteed amount would be the minimum amount that you will receive.

Whole Life policies tend to be the most expensive policies since they build a great deal of cash value, and are designed to last a lifetime.

Universal Life: Is also designed to be permanent, but is more flexible then Whole-Life. There is also cash value with Universal Life, but the cash value is flexible and more fluid. This cash value can be borrowed against and the value grows tax deferred. Many universal life policies have some guarantees built into their structure. The focus of the guarantee is the “death benefit” as opposed to the cash value. A Guaranteed Universal Life or GUL life policy is a subset of a Universal Life Policy.

The problem with Universal Life Policies

The problem with some Universal Life Insurance policies is the tendency to under fund them, because they are flexible. If a policy is underfunded then it will not have the necessary cash to generate income for the later years when the insured is older and insurance becomes more expensive. The cash value in the policy generates tax-free growth, this growth allows the policy to stay in force as an individual gets older. This is an important point to remember, many people are surprised when premiums on their policy start to increase. This is because their policy is running out of money. A GUL policy solves that problem because the Guarantee is locked in by the insurance company at the time of the policy contract.

Why A GUL or Guaranteed Universal Life solves the problem

This type of policy guarantees the death benefit will stay in force regardless of the cash value as long as premium payments are made. The focus of a GUL policy is the death benefit with a guaranteed stipulation assuring the insured the policy will stay in force as long as the insured wants, regardless of cash value inside the policy.

The GUL policy is less expensive than the Whole Life Policy because its goal is to not have cash-value equal to its face amount. The goal of the GUL Policy is to have enough cash to make sure the policy stays in force as long as the insured lives to the guaranteed age. The goal is to guarantee the death benefit.

In a Guaranteed Universal life policy, you can choose the guaranteed age. For example, to guarantee a death benefit to age 90 versus 100, the premium will be less for the shorter guarantee.

Other coverage riders such as coverage for Chronic Care and Critical Illness and Accidental Death add to the versatility of the policy to insure against potential loss.

[1] https://www.ssa.gov/oact/STATS/table4c6.html