When you apply for a life insurance policy, you are asking an insurance company to issue you a contract that pays a death benefit to your beneficiaries. Once the policy is issued the insurance company has an obligation to pay the death benefit if premium is paid. The premium paid is based on your underwritten classification. The Life Insurance Company has three options, these classifications are;

- Decline Classification

- Standard Classification

- Table Rated Classification

Life insurance companies underwrites your life using available metrics such as mortality tables and morbidity tables, these tables allow the insurance company to put the insured into a classification pool of probability. For example, we know through mortality tables, that in the United States for every 1000 50-year-old males 4.8 will die each year[i]. Using these numbers, an insurance company will look for other factors to determine the probability of the “Insured” dying and give them a classification of the risk they are willing to assume.

For example, is someone has a BMI (Body Mass Index of 45) they insurance company might decline coverage, saying in effect, we are not willing to take the risk. This might not seem fair to some, but the insurance company uses actuarial tables to make calculations, taking emotion out of the equation.

- Decline Classification

The Insurance Company is not willing to take the risk, it is declining to offer any insurance to the individual. Based on the information in the application and or other sources they deem the risk too great.

- Standard Classification

There are six standard classifications. Let’s briefly cover some factors that go into these ratings:

- Height: Your height works with your weight a 6’5” individual is going to weigh more than a 5’5” individual. This helps determine your BMI[ii] , they are looking for a healthy weight with the height.

- Weight: This is used in conjunction with your height to determine your BMI.

- Cholesterol: There are several factors, Total Cholesterol score, HDL ratio, and medication.

- Lifestyle: Do you race motorcycles? Are you an airline pilot? Do you have lots of speeding tickets? Your lifestyle is factored into the underwriting. Do you travel to warzones?

- Health History: The insurance company might also ask to see medical records.

- Occupation: What kind of work do you do? Is it risky to your life?

- Family History: How old are your parents? If they passed how old were they, what caused their death? Cancer, Heart, and disease issues can all be included in the underwriting if they are deemed hereditary.

Not all insurance company use the same standards, one might rate higher with for height and weight, another might not consider using an occasional cigar as smoking. There is leeway with these classifications.

Six Standard Classifications

- Preferred Select: This is the best possible classification. Your height and weight are healthy, Cholesterol is good, no outstanding medical issues, no family history issues. The rates are the lowest rate possible.

- Preferred: This is also a great rating, a factor such as height/weight, Cholesterol or blood pressure might keep someone out of Preferred Select status. Sometimes loosing a few pounds before underwriting can change this classification.

- Standard Plus: This rating is above average; some issues might exist such as high-blood pressure or Cholesterol levels.

- Standard: This is average health, there might be some family history issues or some personal health problems. A standard for one company, could mean preferred for another, so it’s important to “Pre-screen” your health before underwriting, one company might be more lenient than another.

- Preferred Tobacco: Your height and weight are healthy, but you smoke or use tobacco. Tobacco users will always get a higher rating even if you are healthy. Occasional Cigar use with some companies, if disclosed might get a pass.

- Standard Tobacco: Your height and weight are average, you use tobacco, without smoking you would classify as standard.

- Table Rated Classification

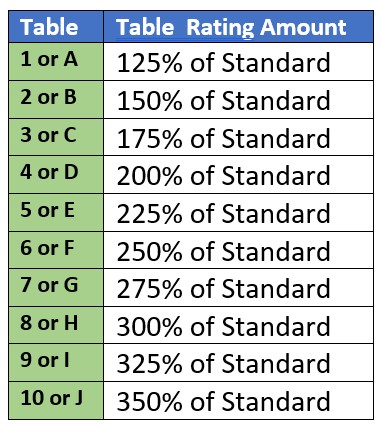

When your health is outside of the Standard Classification the other option is to table rate you. This is called a Substandard category; the insurance company uses either letters or numbers for the category levels. (1-10 or A-J). This category is used because your issues are outside of the standard levels. Meaning your health history, height and weight or lifestyle has caused this classification.

The premium will increase by a factor of 25% per level, so a Table 1 or A would mean you will pay 25$ more than the Standard Rating. If your Standard Rating was $50.00 per month your premium would be $62.50 per month.

This means the insurance company is willing to take the risk, but they need to raise the rates to a level to compensate for the level of risk they are taking. Beyond these classifications is a decline to cover classification.

[i] https://www.ssa.gov/oact/STATS/table4c6.html#fn1

[ii] https://www.nhlbi.nih.gov/health/educational/lose_wt/BMI/bmicalc.htm