Return of Premium for Term Life Insurance?

One of the biggest complaints about life insurance is that you must die to collect. For that reason, many are reluctant, because most of us do not plan on dying. We imagine everything we could be doing with our premium payments, especially if we get term life insurance. If we outlive our policy, we think we wasted all that money. Return of Premium Term Life Insurance is the answer to that problem.

What is Return of Premium Life Insurance?

Pure and simple, Return of Premium Term Insurance is a refund of premiums paid over the life of a term policy if you don’t pass by the time the policy ends, you get a check for the full amount paid over the For example, if your premium was 1,000/year for 30 years, at the end of the 30 years you would receive a $30,000 refund for premiums paid. ROP or Return of Premium is a rider, that is attached to a term policy allowing for the refund of premiums paid. Not all life insurance companies offer ROP on their term policies. To have an ROP rider, you pay an additional premium, so it is important to evaluate whether it is to your advantage or would you be better off investing the difference.

Pros and Cons of return of premium life insurance

Here are some pros and cons to consider when looking at an ROP rider on a term insurance policy. The cons are:

- There is limited availability, not many companies are offering an ROP with their term policies.

- You are paying a higher premium, so you need to weigh the cost of the extra premium to determine if it’s worth it.

- If you cancel the policy early, you lose a portion of your surrender values

However, there are advantages to an ROP rider for some, but each situation is different. There are so many pros to an ROP rider.

- You receive the premium you paid into the policy at the end of the term.

- For an extra premium, you have a built-in savings plan with your term insurance

- You can convert your term policy into a permanent one if the need arises.

Who should get it?

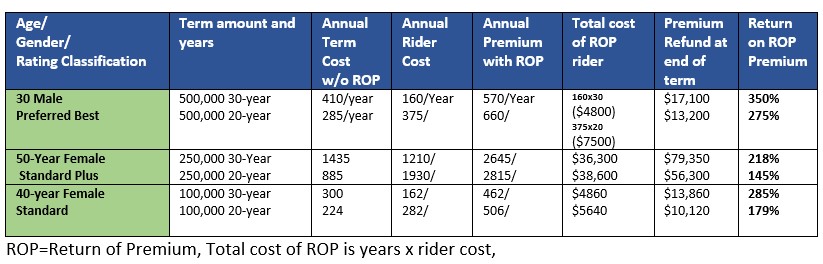

Each situation should be evaluated separately, but the numbers speak for themselves, see examples below.If you are young and healthy and interested in a 30-year term, you should look at an ROP rider. Thirty years of compound interest makes the rider less expensive than a 20-year term. A 350% return on my ROP, premium? Yes, the numbers speak for themselves, the 30-year term policies offer the biggest return for the extra premium, because of the power of compound interest. Below are some real examples to consider.

The best available ROP policy

The best policy right now available for Return of Premium Term Life Insurance is Assurity Life, they have a great return on the extra premium paid on their term policies, but each situation should be evaluated separately. We can work through all the scenarios with you and help know if an ROP rider is for you.