What is term life insurance

Term Life Insurance

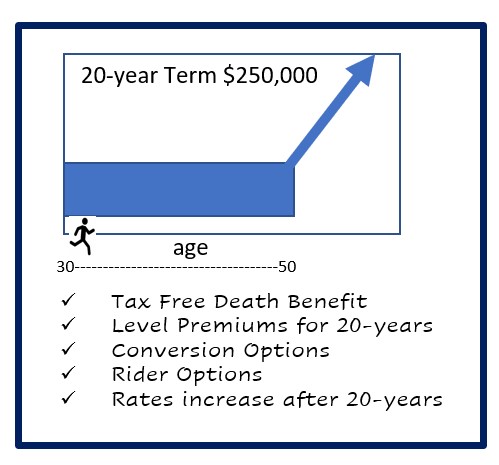

Characteristics of Term Life

- Term is less expensive than a permanent policy (Whole Life, Universal Life)

- Term Life provides coverage for a “Term” of time, the longer the term the more expensive the policy. For example, 10-year term vs. 20-year term, a 10-year term is less expensive.

- Term Life Insurance does not build cash value, unless there is a ROP (Return of Premium) Rider in the policy, this rider is additional cost.

- Term Life allows a “Tax Free” death benefit to the beneficiaries.

- Polices rates are based on the following variables. The age of the insured, gender, health status, length of term, and the face amount, this is part of the underwriting process.

- Term Life polices are mainly “Level” premium meaning the premium is the same during the term period. At the end of the term, the rates go up annually depending on the contract.

- Term polices have the option to be converted to Whole Life or Universal Life type policy without medical underwriting. In essence a term policy allows you to keep the underwriting level you had when you first applied, regardless of events during the term. This is one of the most important aspects of term, because it protects from the unknown events in the future.

- Term Life is great choice because its less expensive than a permanent policy with the option of convertibility. Term also allows you to cover for specific periods, such as 15-years or 30-years the length of a mortgage. Term makes insurance affordable for everyone.